A bank reconciliation statement is produced after comparing the cash balance on a balance sheet to the corresponding balance on the bank statement. This act of reconciliation helps to identify whether accounting changes need what is a tax deduction to be made. Taking the time to perform a bank reconciliation can help you manage your finances and keep accurate records. This relatively straightforward and quick process provides a clear picture of your financial health.

Missed reconciliations

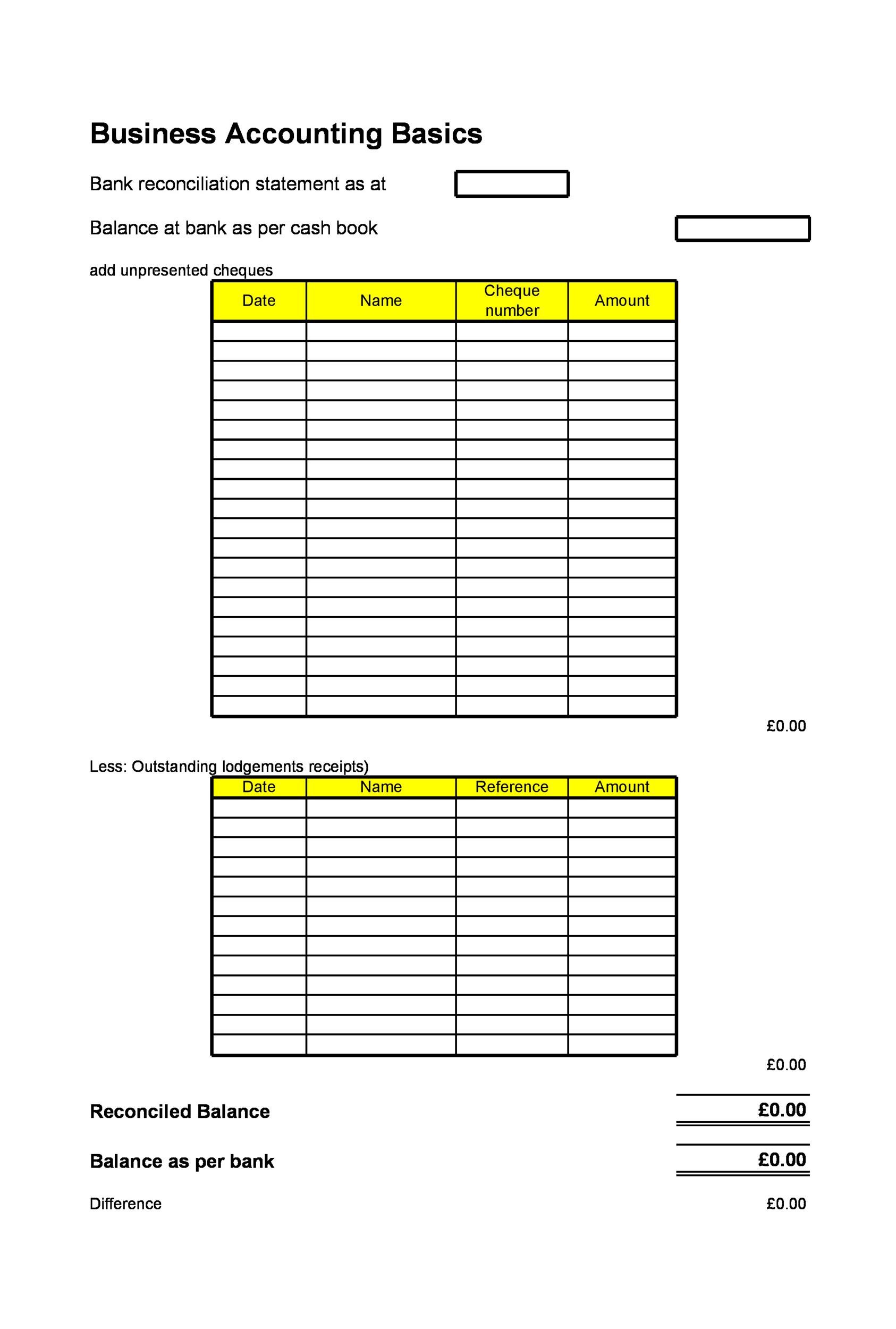

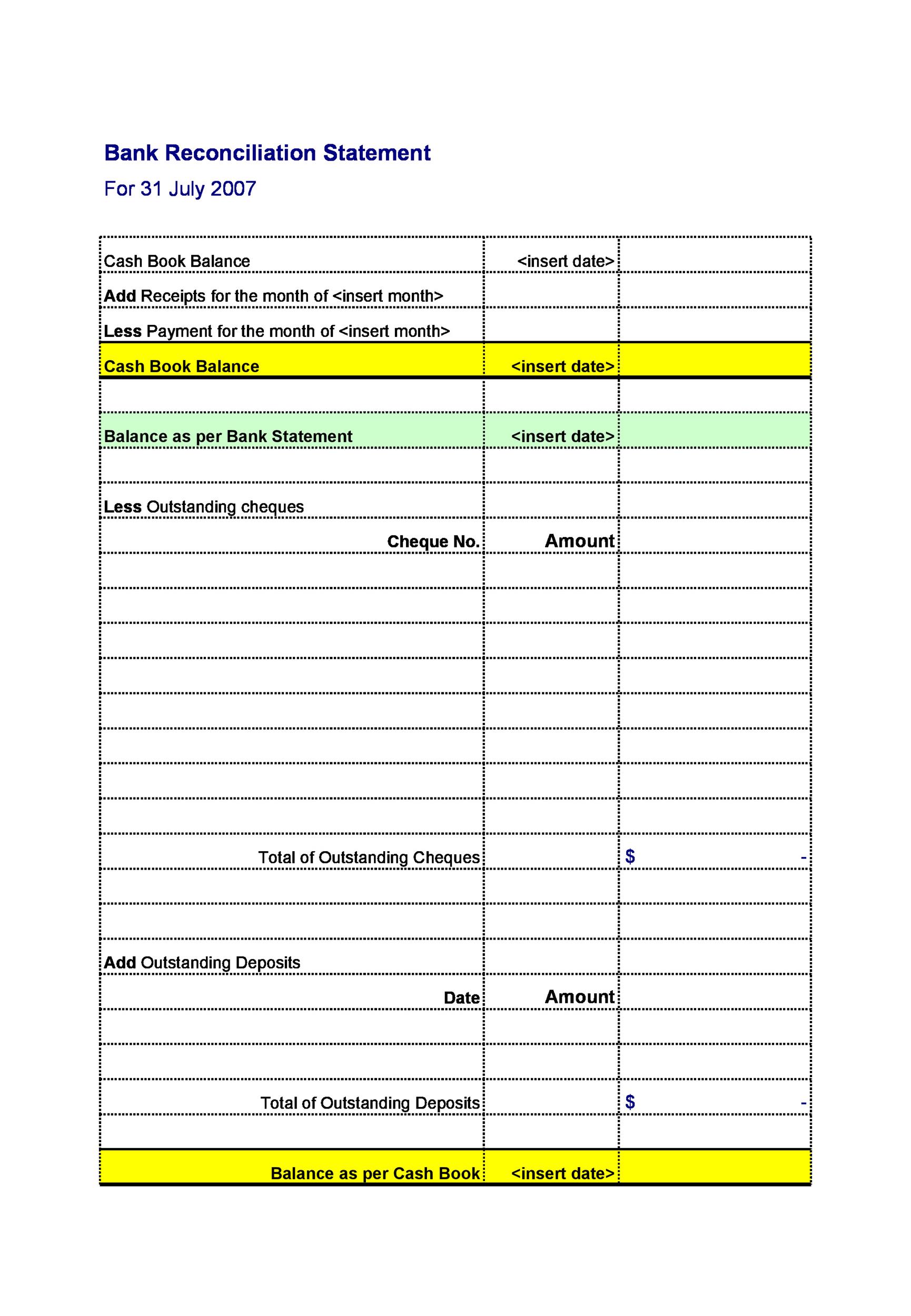

When the amounts aren’t equal, you’ll need to verify the numbers, fix any errors, and repeat the reconciliation process to find out where the discrepancy is. Although fintech and automation are widely celebrated, there are still some accounting practices that need a keen set of human eyes. Reconciling items include uncleared cheques, uncredited deposits, direct debits, and more.

Can you provide examples and solutions for bank reconciliation?

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Who are the parties involved in a bank reconciliation statement?

By comparing the bank statement with the company’s own records, any errors or discrepancies can be identified and corrected promptly. This ensures that the financial statements accurately reflect the company’s financial position. Reconciling is the process of comparing the cash activity in your accounting records to the transactions in your bank statement. This process helps you monitor all of the cash inflows and outflows in your bank account. The reconciliation process also helps you identify fraud and other unauthorized cash transactions.

- Bank reconciliation accounting is performed by the accounts payable department.

- The purpose of bank reconciliation is to ensure that all transactions have been recorded correctly and that the company’s financial statements are accurate.

- The final balance on the bank reconciliation statement, after all corrections and adjustments, is the actual “true” cash balance reported in the company’s balance sheet.

- Checks that have been issued by a business to creditors and credited in a cash book–but the payments have not yet been processed by a bank and so do not appear on a bank statement.

Reconciling your bank statement used to involve using a checkbook ledger or a pen and paper, but modern technology—apps and accounting software—has provided easier and faster ways to get the job done. Regardless of how you do it, reconciling your bank account can be a priceless tool in your personal finance arsenal. Bank reconciliation statements compare transactions from financial records with those on a bank statement. Where there are discrepancies, companies can identify and correct the source of errors.

What is bank reconciliation, & Why is it important?

This guide explores the essentials of bank reconciliation, the steps involved, and best practices to help businesses maintain clear, reliable financial records. A bank reconciliation is an essential process for ensuring that your company’s financial statements match the available cash in your business bank account. Performing regular bank reconciliations helps you stay on top of cash flow, keep organized records for tax season, and minimize the risk of fraud and theft. In the absence of proper bank reconciliation, the cash balances in your bank accounts could be much lower than expected, which may result in bounced checks or overdraft fees. Bank reconciliation is a process that ensures the accuracy of a company’s financial records. It involves comparing the bank statement with the company’s accounting records to identify any discrepancies between the two.

A bank statement is a document that lists all transactions that have occurred in a bank account during a specific period. Every time cash, checks, money orders, or postal orders (or anything else) are deposited in the bank, the cash book (bank column) is debited. That’s to say, an entry is made in the bank column on the debit side of the cash book.

The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

If done regularly, a bank reconciliation easily helps you identify discrepancies so that you can adjust them. Companies face several challenges when reconciling bank statements to financial activities, so it’s important to highlight common problems you may encounter. The deposit could have been received after the cutoff date for the monthly statement release. Depending on how you choose to receive notifications from your bank, you may receive email or text alerts for successful deposits into your account.