Closing the books also locks in the prior period transactions so people can’t change those balances without proper authorization. After you’ve transferred your income and expenses into the Income Summary account, you’ll close that account, moving the balance to Retained Earnings, which is a permanent account. You may also produce an owner’s equity statement, Which shows changes in the value of all equity accounts belonging to the company’s owners or shareholders. For example, you have made an entry where you debited the Entertainment account for $40 and credited cash $40. Now, this transaction will affect the Cash and Entertainment account only, where, on the Cash T Account, you will decrease or put his $40 amount on the right side of the T account. We collaborate with business-to-business vendors, connecting them with potential buyers.

Adjusting:

Keep in mind that accrual accounting requires the matching of revenues with expenses so both must be booked at the time of sale. The general ledger is the official record of the accounting period. It includes beginning balances for each account, all transactions impacting those accounts during the accounting period, and each account’s ending balance. Without the ledger, business owners couldn’t generate reports, prepare financial statements, or analyze the results of their day-to-day operations. After accountants and management analyze the balances on the unadjusted trial balance, they can then make end of period adjustments like depreciation expense and expense accruals. These adjusted journal entries are posted to the trial balance turning it into an adjusted trial balance.

- If you have a staff, give them the tools they need to succeed in implementing the accounting cycle.

- This entry needs to reference where the error exists so that anyone reviewing it can verify it for accuracy.

- A business’s accounting period depends on several factors, including its specific reporting requirements and deadlines.

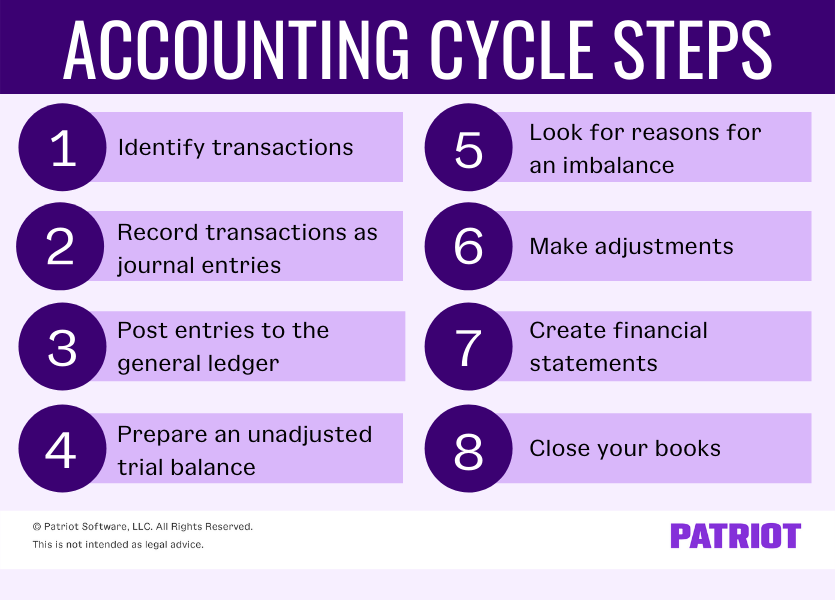

The 8 Important Steps in the Accounting Cycle

Beyond sales, there are also expenses that can come in many varieties. The accounting cycle is important because it gives companies a set of well-planned steps to organize the bookkeeping process to avoid falling into the pitfalls of poor accounting practices. Before you create your financial statements, you need to make adjustments to account for any corrections for accruals or deferrals. Accruals make sure that the financial statements you’re preparing now take those future payments and expenses into account.

Post Journal Entries to General Ledger

A business’s accounting period is determined by various factors, including reporting obligations and deadlines. The accounting period refers to the timeframe for preparing financial documents, varying from monthly to annually. Companies may opt for monthly, quarterly, or annual financial analyses based on their specific needs.

What Is The Accounting Cycle? Explained Step by Step

Typically, companies integrate their accounting software with their payment processor and point-of-sale (POS) software to capture revenue. Disorganized books can lead to bad decisions, failure to fulfill various obligations and sometimes even legal problems. That’s why today we will discuss the eight accounting cycle steps you can follow to ensure accuracy. After analyzing transactions, now is the time to record these transactions in the general journal. A general journal records all financial transactions in chronological order.

It breaks down the entire process of a bookkeeper’s responsibilities into eight basic steps. Many of these steps can be automated through accounting software and other technology, including artificial intelligence. However, knowing the steps and sales tax calculator and rate lookup tool how to complete them manually can be essential for small business accountants working on the books with minimal technical support. Once you identify your business’s financial accounting transactions, it’s important to create a record of them.

Subsequent steps are necessary to prepare the accounts for the next accounting period (steps 8-9). In addition to identifying any errors, adjusting entries may be needed for revenue and expense matching when using accrual accounting. At the end of the accounting period, a trial balance is calculated as the fourth step in the accounting cycle. A trial balance shows the company its unadjusted balances in each account.

According to the rules of double-entry accounting, all of a company’s credits must equal the total debits. If the sum of the debit balances in a trial balance doesn’t equal the sum of the credit balances, that means there’s been an error in either the recording or posting of journal entries. The next step of the accounting cycle is to organize the various accounts by preparing two important financial statements, namely, the income statement and the balance sheet. The income statement lists all expenses incurred as well as all revenues collected by the entity during its financial period. These expenses and revenues are compared to reveal the net income earned or net loss sustained by the entity during the period. This step summarizes all the entries recorded by the business during a particular period, which is generally the financial year of the entity.

The culmination of these steps is the preparation of financial statements. Some companies prepare financial statements on a quarterly basis whereas other companies prepare them annually. This means that quarterly companies complete one entire accounting cycle every three months while annual companies only complete one accounting cycle per year. For example, when a transaction is recorded using accrual accounting, it happens at the time of the sale.

The accounting cycle ends with closing the books, typically occurring at the end of a month, quarter, or fiscal or calendar year. If a transaction is accepted, you can move on to recording it in the company’s books. If it was an error or looks suspicious, you should reach out to the customer or vendor to remove or replace it.

Next, you’ll use the general ledger to record all of the financial information gathered in step one. Recording entails noting the date, amount, and location of every transaction. Next, you’ll break down (or analyze) the purpose of each transaction. For example, if a receipt is from Walmart, was it office supplies? This ICT Sector Guidance is built on, and in conformance with, the GHG Protocol Product Standard. Your bookkeeper should “accept” every transaction to ensure that it is accurate and it was purposely placed.